NECO Bookkeeping OBJ 2025

01-10: CDADDCDEBC

11-20: CCECDCDBAC

21-30: ADDDAACEDD

31-40: BDECBACDBA

41-50: CBDCECBDBC

51-60: CDEBDBEEEA

COMPLETED!!!

NECO Bookkeeping Essay 2025

Number 1

Answers Loading…

==================

Number 2

(2a)

A trading account is prepared to determine the gross profit or gross loss of a business from buying and selling goods during an accounting period. It shows the difference between sales and cost of goods sold (COGS).

(2b)

(i) Fixed Capital: This is capital invested in long-term assets like buildings, machinery, and land. It is not intended for day-to-day operations.

(ii) Working Capital: This is the capital used for daily operations of the business. It is calculated as current assets minus current liabilities.

(iii) Loan Capital: This is money borrowed by the business from external sources such as banks, to be repaid with interest.

(iv) Equity Capital: This refers to the money invested in the business by its owners/shareholders in return for ownership.

(v) Venture Capital: This is funding provided by investors to startups or small businesses with growth potential, often in exchange for equity or partial ownership.

(2c)

(i) Business Entity Concept

(ii) Money Measurement Concept

(iii) Going Concern Concept

(iv) Accrual Concept

(v) Consistency Concept

(vi) Prudence Concept.

==================

Number 3

(3a)

(i) First In First Out (FIFO): This method assumes that the earliest (first) stock purchased is the first to be issued or sold. It values closing stock using the cost of the most recent purchases.

(ii) Last In First Out (LIFO): This method assumes that the most recent (last) stock purchased is the first to be issued or sold. It values closing stock using the cost of the earliest purchases.

(iii) Weighted Average Price (WAP): This method calculates the average cost of all available stock (total cost divided by total quantity). All stock issued or remaining is valued at this average cost

(3b)

(i) Salaries and wages

(ii) Rent and rates

(iii) Insurance expenses

(iv) Depreciation of assets

(v) Repairs and maintenance

(vi) Advertising expenses

(vii) Electricity and water bills

(3c)

(i) Invoice

(ii) Receipt

(iii) Credit note

(iv) Debit note

(v) Cheque counterfoil

(vi) Payment voucher

==================

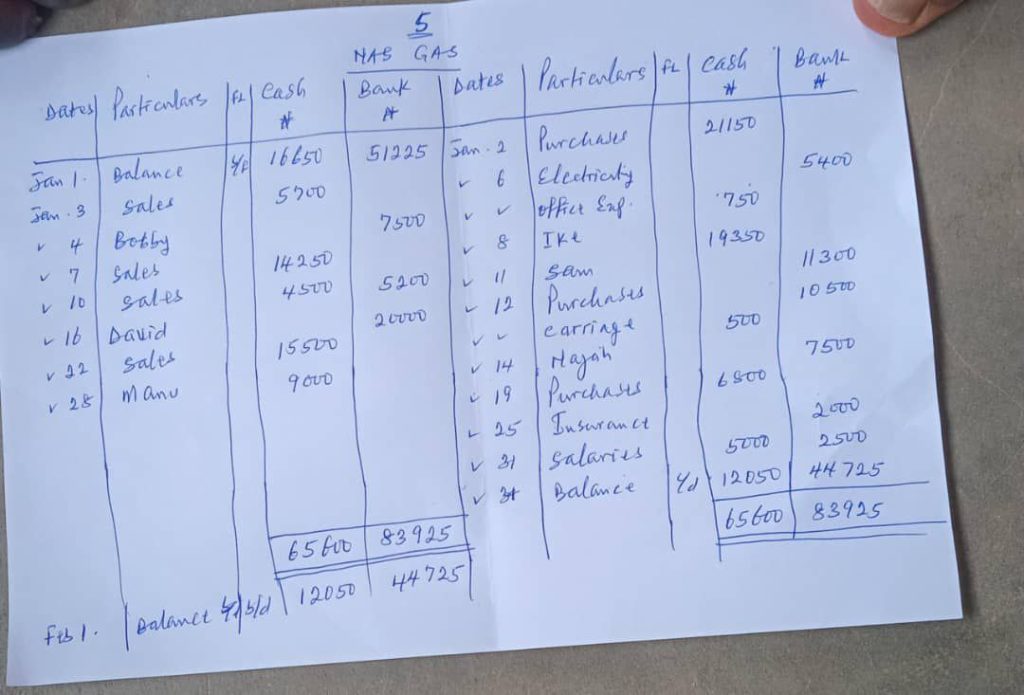

Number 5

==================

Number 6

(6i)

Preparation of Financial Statements for B. Oko and Sons as at 31st July, 2015

(i)Trading Account

Opening Stock:

N100,000

Purchases:

N112,000

Carriage Inwards:

N8,000

Less: Returns Outward:

N4,000

Cost of Goods Available for Sale:

N100,000 + N112,000 + N8,000 – N4,000 = N216,000

Less: Closing Stock:

N21,000

Cost of Goods Sold:

N216,000 – N21,000 = N195,000

Sales:

N250,000

Less: Returns Inwards:

N8,000

Net Sales:

N250,000 – N8,000 = N242,000

Less: Goods drawn for domestic use:

N9,000

Net Sales for Trading Account:

N242,000 – N9,000 = N233,000

Gross Profit:

N233,000 – N195,000 = N38,000

(6ii)

Profit and Loss Account

Gross Profit:

N38,000

Add: Discount Received:

N2,000

Total Income:

N38,000 + N2,000 = N40,000

Less: Expenses:

Salaries and Wages:

N10,000

Electricity:

N3,200

Insurance:

N3,500

Discount Allowed:

N500

Carriage Outwards:

N2,800

Stationery and Printing:

N2,400

Rent and Rates (N6,000 – N8,000 prepaid):

N6,000 – N8,000 = (N2,000) (This indicates that Rent and Rates are overpaid and should be treated as an asset in the balance sheet, not an expense in the P&L for the current period)

Depreciation on Equipment (10% of N50,500):

N5,050

Depreciation on Furniture (5% of N12,000):

N600

Total Expenses:

N10,000 + N3,200 + N3,500 + N500 + N2,800 + N2,400 + N5,050 + N600 = N28,050

Net Profit:

N40,000 – N28,050 = N11,950

(6iii)

Balance Sheet as at 31st July, 2015

Assets

Current Assets:

Cash in Hand:

N5,000

Debtors:

N20,000

Closing Stock:

N21,000

Rent and Rates Prepaid:

N8,000

Fixed Assets:

Equipment at Cost:

N50,500

Less: Accumulated Depreciation (Equipment):

N5,050

Net Book Value (Equipment):

N45,450

Furniture at Cost:

N12,000

Less: Accumulated Depreciation (Furniture):

N600

Net Book Value (Furniture):

N11,400

Liabilities

Current Liabilities:

Creditors:

N6,000

Long-term Liabilities:

Loan:

N12,000

Equity

Capital (Opening):

N66,000

Add: Net Profit:

N11,950

Less: Drawings (Goods):

N9,000

Closing Capital:

N66,000 + N11,950 – N9,000 = N68,950

Total Assets should equal Total Liabilities + Equity

==================

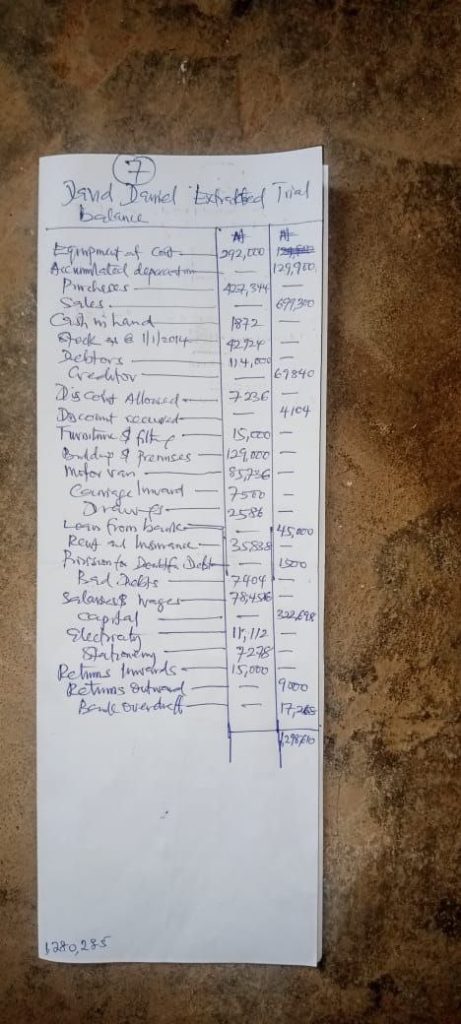

Number 7

==================

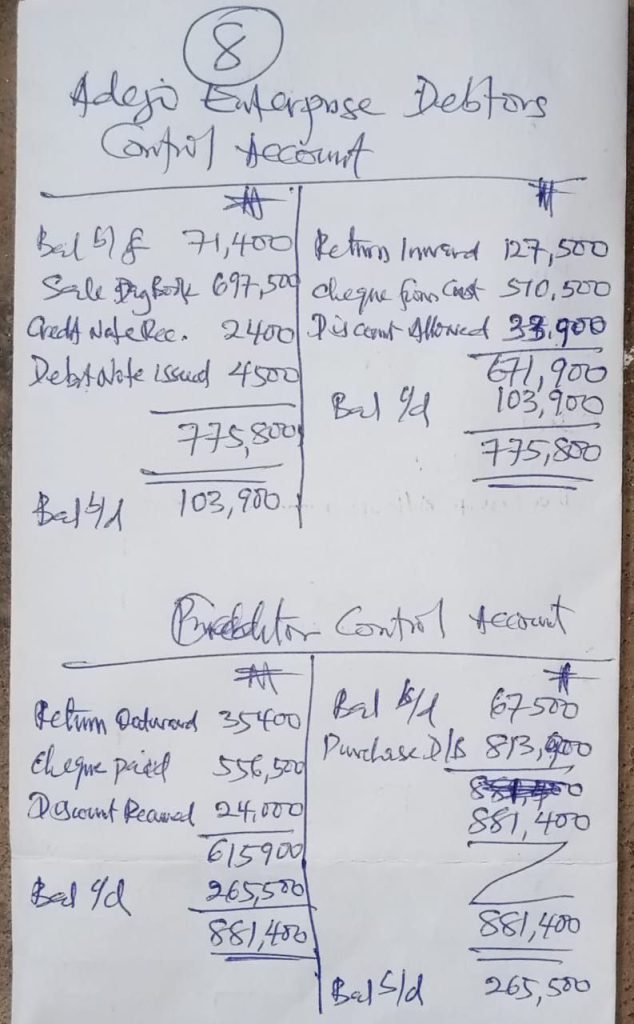

Number 8

COMPLETED!!!