WAEC Commerce OBJ 2025

01-10: CBBADBCCCA

11-20: CCBABDABAD

21-30: AACABACCAA

31-40: BCADDADDBA

41-50: DACCDDDABD

COMPLETED!!!

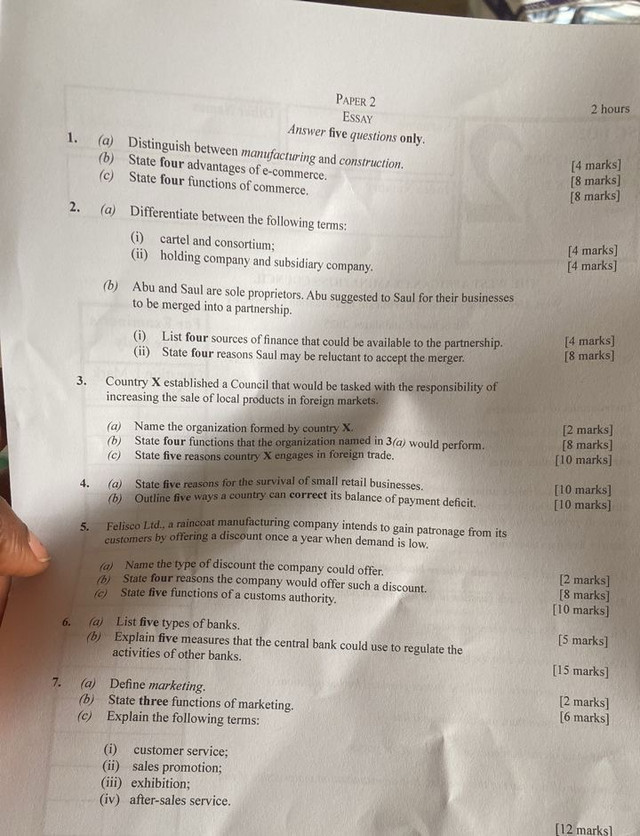

WAEC Commerce Essay 2025

Number 1

(1a)

Manufacturing is the process of producing goods in factories using machines and labor, usually in a controlled, repetitive, and standardized environment.

WHILE

Construction is the process of building structures on-site, often involving unique designs and adapting to site-specific conditions.

(1b)

(PICK FOUR ONLY)

(i) Global Reach: E-commerce allows businesses to reach customers worldwide, breaking geographical barriers.

(ii) 24/7 Availability: Online stores operate around the clock, offering convenience to customers at any time.

(iii) Cost Reduction: Lower operating costs compared to physical stores due to reduced need for rent, utilities, and in-store staff.

(iv) Faster Transactions: Purchases and payments can be completed quickly online, improving customer satisfaction.

(v) Personalized Marketing: Businesses can use customer data to offer personalized recommendations and promotions.

(vi) Broader Product Range: Online platforms can display more products than physical stores, without space limitations.

(vii) Improved Inventory Management: Automation tools in e-commerce help manage inventory more efficiently.

(viii) Easy Access to Customer Feedback: Reviews and ratings provide valuable insights to improve products and services.

(1c)

(PICK FOUR ONLY)

(i) Exchange of Goods and Services: Facilitates buying and selling activities between producers and consumers.

(ii) Transportation: Ensures the movement of goods from producers to markets and consumers.

(iii) Warehousing: Provides storage facilities to preserve goods until they are needed for sale.

(iv) Banking: Offers financial services such as credit, loans, and payment systems to support trade.

(v) Insurance: Protects businesses against risks like theft, damage, or loss of goods.

(vi) Advertising: Promotes products and services to inform and attract customers.

(vii) Communication: Enables quick and efficient exchange of information in business transactions.

(viii) Financing: Provides capital needed for production, transportation, and marketing of goods.

Number 2

(2ai)

A cartel is a group of independent businesses in the same industry who agree to control prices and limit competition (usually illegal).

While

A consortium is a temporary alliance of businesses or organizations that collaborate to achieve a common goal, like a big project.

(2aii)

A holding company owns enough shares in other companies to control them but may not produce goods/services itself.

While

A subsidiary company is controlled by a holding company through majority shareholding.

(2bi)

(i) Personal savings of the partners

(ii) Loans from banks

(iii)Retained profits

(iv) Contributions from new partners

(2bii)

(i)Fear of losing control or autonomy

(ii) Differences in business goals or values

(iii)Unequal sharing of profits and responsibilities

(iv)Concern over potential conflicts or disagreements

Number 3

(3a)

Trade Promotion Council

(3b)

(PICK FOUR ONLY)

(i) Market Research: Conducts research to identify potential international markets for local products.

(ii) Export Promotion: Organizes campaigns and trade fairs to promote local products abroad.

(iii) Advisory Services: Offers guidance and support to local businesses on export procedures and market entry strategies.

(iv) Training and Capacity Building: Provides training programs for exporters to enhance their knowledge and skills in international trade.

(v) Product Development Support: Assists in improving product quality and packaging to meet international standards.

(vi) Trade Negotiations: Engages in trade negotiations to secure favorable terms for local exporters.

(vii) Market Linkages: Connects local producers with foreign buyers and distributors.

(viii) Policy Advocacy: Advises the government on policies that support export growth and competitiveness.

(3c)

(PICK FIVE ONLY)

(i) Access to wider markets: To sell local products to a larger international customer base.

(ii) Earning foreign exchange: To generate revenue in foreign currencies, which strengthens the national economy.

(iii) Access to resources: To obtain raw materials and goods not available locally.

(iv) Promotion of specialization: To focus on producing goods in which the country has a comparative advantage.

(v) Job creation: To create employment opportunities in export-oriented industries.

(vi) Improved standards of living: To provide citizens with access to a wider variety of goods and services.

(vii) Technology transfer: To benefit from advanced technologies and innovations from trading partners.

(viii) Strengthening international relations: To build diplomatic and economic ties with other countries.

Number 4

(4a)

(PICK ANY FIVE)

(i) Personalized customer service: They offer closer customer relationships and tailored service.

(ii) Flexible operations: Small retailers can quickly adapt to market changes.

(iii) Low overhead costs: They often operate with minimal expenses.

(iv) Strategic location: Many are located close to residential areas for convenience.

(v) Niche markets: They serve specific customer needs that large retailers may overlook.

(vi) Quick decision-making: Owners can make decisions without bureaucracy.

(vii) Strong community ties: They often enjoy local loyalty and support.

(4b)

(PICK ANY FIVE)

(i) Promoting exports: Encouraging the production and sale of goods abroad.

(ii) Import substitution: Reducing reliance on imported goods by producing them locally.

(iii) Currency devaluation: Lowering the value of the national currency to make exports cheaper.

(iv) Attracting foreign investment: Bringing in capital to boost economic activity.

(v) Tourism development: Increasing foreign exchange earnings through tourism.

(vi) Restricting imports: Using tariffs or quotas to reduce non-essential imports.

(vii) Securing foreign aid or loans: Temporarily covering deficits while corrective measures take effect.

Number 5

(5a)

Seasonal discounts

(5b)

(PICK ANY FOUR)

(i) To encourage purchases during periods of low demand.

(ii) To maintain steady production and reduce idle time.

(iii) To clear out old stock or inventory before the next season.

(iv) To improve cash flow during slow business periods.

(v) To attract new customers and retain existing ones.

(vi) To stay competitive in the market and gain market share.

(5c)

(PICK ANY FIVE)

(i) To collect import and export duties and taxes.

(ii) To enforce laws regulating the import and export of goods.

(iii) To prevent the entry of prohibited and dangerous goods.

(iv) To facilitate legitimate international trade.

(v) To compile trade statistics and monitor trade trends.

(vi) To protect local industries by implementing tariffs and trade policies.

Number 6

(6a)

(PICK ANY FIVE)

(i) Commercial banks

(ii) Central bank

(iii) Development banks

(iv) Merchant banks

(v) Mortgage banks

(vi) Microfinance banks

(vii) Agricultural banks

(6b)

(PICK ANY FIVE)

(i) Reserve Requirement Ratio: The central bank mandates the percentage of total deposits that commercial banks must keep as reserves. This controls how much money banks can lend, thus influencing liquidity.

(ii) Open Market Operations (OMO): The central bank buys or sells government securities in the open market to control the money supply. Selling securities reduces liquidity, while buying increases it.

(iii) Interest Rate Policy (Bank Rate): By raising or lowering the rate at which commercial banks borrow from it, the central bank influences the interest rates charged by commercial banks to their customers.

(iv) Licensing and Supervision: The central bank grants licenses to banks and supervises their operations to ensure compliance with regulations and financial soundness.

(v) Credit Control: The central bank can impose limits on the amount of credit banks can extend or set guidelines on lending priorities to sectors of the economy.

(vi) Moral Suasion: The central bank uses persuasion and appeals to influence banks’ behaviors, such as urging them to reduce lending or improve financial practices, without enforcing formal regulations.

Number 7

(7a)

Marketing is the process of identifying, anticipating, and satisfying customer needs and wants profitably.

(7b)

(PICK ANY THREE)

(i) Market research: Gathering and analyzing information about consumers and market trends.

(ii) Product development: Creating products that meet customer needs.

(iii) Promotion: Communicating product benefits to customers to encourage purchase.

(iv) Pricing: Setting competitive prices that reflect value and market conditions.

(v) Distribution: Delivering products to customers through appropriate channels.

(vi) Customer relationship management: Building and maintaining strong relationships with customers.

(7ci)

Customer service: Customer service refers to the assistance and advice provided by a company to those who buy or use its products or services. It includes answering inquiries, handling complaints, and ensuring customer satisfaction.

(7cii)

Sales promotion: Sales promotion involves short-term incentives used to encourage the purchase or sale of a product or service, such as discounts, coupons, contests, and buy-one-get-one-free offers.

(7ciii)

Exhibition: An exhibition is a public display where businesses showcase their products or services to potential buyers, partners, or the general public, often used as a marketing tool to attract attention and increase brand awareness.

(7civ)

After-sales service: After-sales service is the support provided to customers after they have purchased a product, including installation, training, maintenance, repairs, and warranty services. It helps ensure customer satisfaction and repeat business.

COMPLETED!!!

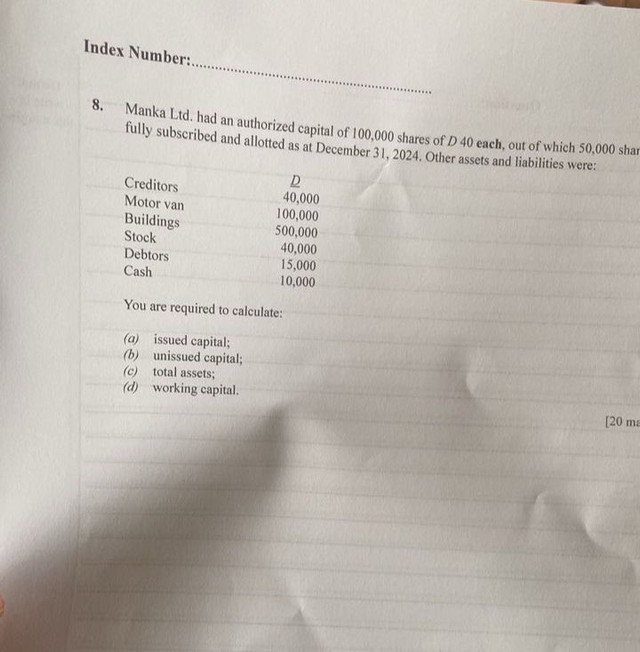

WAEC 2025 Commerce Question Papers